Pfizer

Pfizer gets a lot of coverage in the financial papers–even if some of it turns out to be misguided.

For example, Pfizer got the media coverage all drug companies desire on May 4 from Seeking Alpha, http://seekingalpha.com/article/560531-pfizer-alzheimers-drugs-will-carry-stock-to-new-highs-in-2013

a stock market blog that provides free stock market analysis. A piece entitled “Pfizer: Alzheimer’s Drugs Will Carry Stock To New Highs In 2013” had a subheading “strong pipeline.”

Turns out that was too optimistic, as Pfizer’s Alzheimer’s drug–along with Johnson and Johnson’s–both failed to produce. But many stock analysts still hold hope that Pfizer has a new ‘cash cow’ coming down the pipeline.

notes that Pfizer currently has 87 drugs in its pipeline. While its true that most are in the early stages, 11 are ready to be reviewed by the FDA.

That number puts it ahead of most of its rivals, with Eli Lilly, a close second, having 63 drugs in Phases 1-3, plus one currently being reviewed. Bristol-Myers Squibb has 46 drugs in development, 7 under review, Merck has 35 drugs in Phase 2 or 3 with two under review, and Johnson and Johnson has 18 drugs that are already in Phase 3 clinical trials or up for FDA approval.

But, of course, as the journal points out, “Quality trumps quantity. . . . One or two blockbusters can be better than several lower-revenue drugs.”

So what does Pfizer have up its sleeve that might begin to fill the very big shoes of Lipitor?

Well, the company has diversified the therapeutic areas under research, with 26% of R&D efforts going toward oncology treatments, 20% to neuroscience and pain, 17% to cardiovascular and metabolic diseases, 14% to inflammation and immunology, 5% to vaccines, and 18% toward ‘other.’

Pfizer has several medicines for diabetes alone coming up, in Phase I and Phase II trials, almost all meant to treat type 2 diabetes.

But, notes Seeking Alpha,http://seekingalpha.com/article/560531-pfizer-alzheimer-s-drugs-will-carry-stock-to-new-highs-in-2013

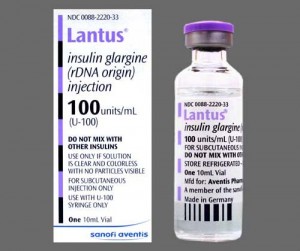

its blockbuster potential in this area is limited by the existing treatments of Merck and Sanofi. 10% of Sanofi’s total sales come from Lantus,

a diabetes drug useful for both types 1 and 2, and Merck made $1.3 billion off its Januvia

franchise in the first quarter of this year alone.

So hopes are pinned on Pfizer’s tofacitinib, currently under FDA review, as the treatment with the potential to earn $1 billion or more in sales, easing the gaping wound left by Lipitor. Tofacitinib prompts such high hopes because it might possibly treat rheumatoid arthritis, psoriasis, and irritable bowel syndrome. Some analysts have pinned this as the cash cow Pfizer so badly needs to replace treatments lost to the patent cliff.

Tofacitinib

If it gets approved, Tofacitinib would be first treatment for rheumatoid arthritis (RA) in a new class of medicines (known as Jenus kinase, or JAK, inhibitors), and the first JAK inhibitor approved for rheumatoid arthritis.

Tofacitinib showed statistically significant improvement compared to placebo in decreasing the symptoms of RA (as measured by 20% improvement in the American College of Rheumatology scale), in improving physical function (as measured by mean change in Health Assessment Questionnaire-Disability Index), and in leading to remission (as measured by Disease Activity Score 28 ESR).

Joel Kremer, MD, chief of medicine at Albany Medical College in N.Y., after analyzing the data, commented, “Tofacitinib appears to reduce the signs and symptoms of rheumatoid arthritis very quickly. We hope that after carefully considering the benefit/risk equation, this compound will provide an additional valuable treatment option for patients who have experienced inadequate response to prior treatments.”

Pfizer also believes its blood thinner Eliquis, which it is developing with Bristol-Myers Squibb (see below) could be a big money-maker.

apixaban, eliquis

No comments:

Post a Comment